The Value of Debt: How to Manage Both Sides of a Balance Sheet to Maximize Wealth: Anderson: 9781118758618: Amazon.com: Books

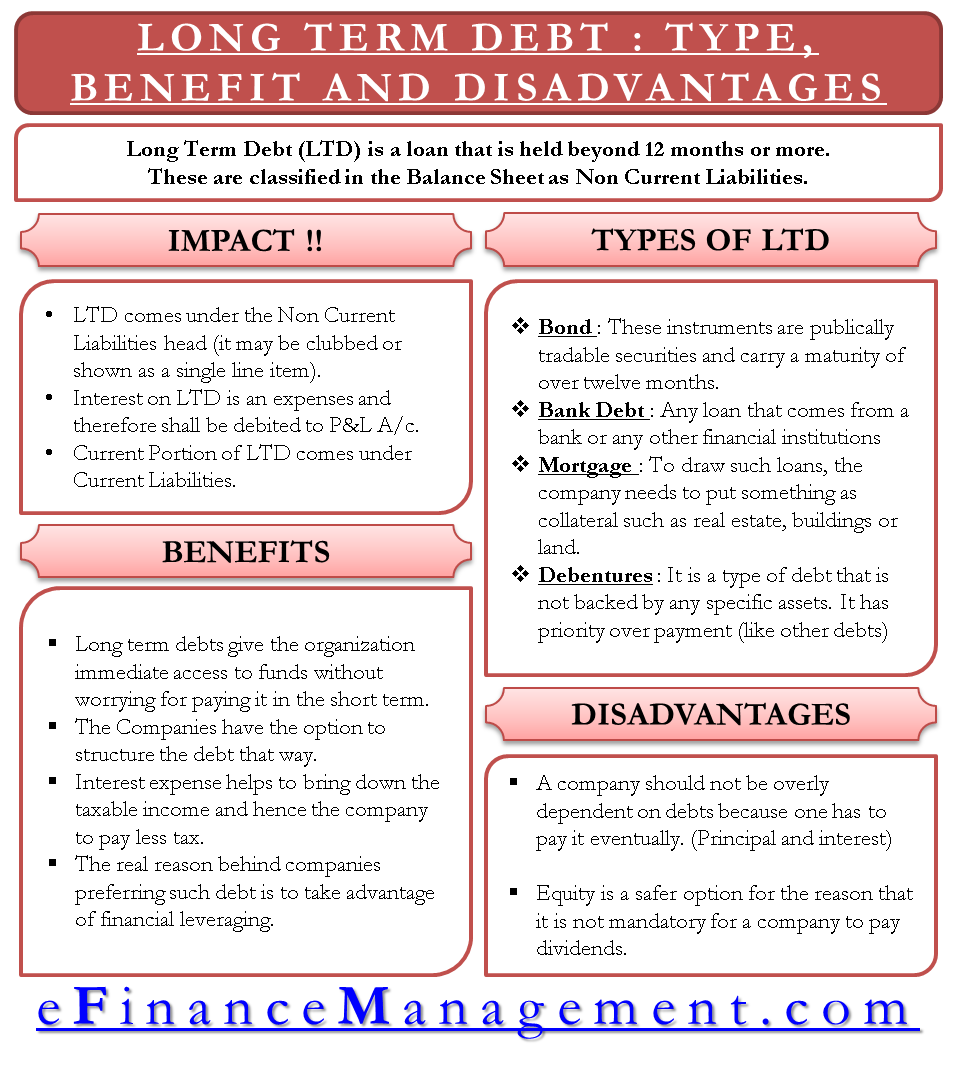

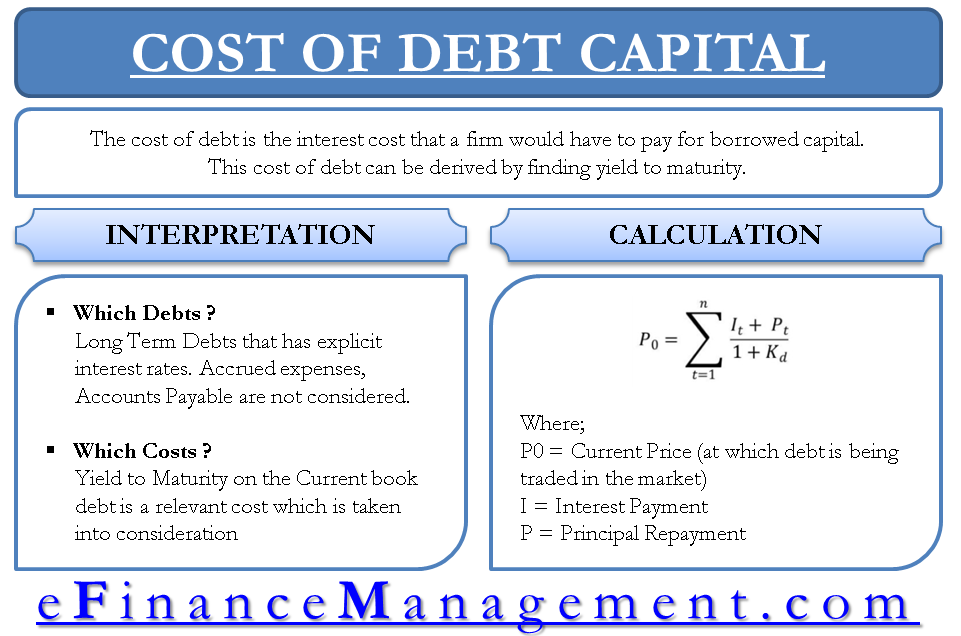

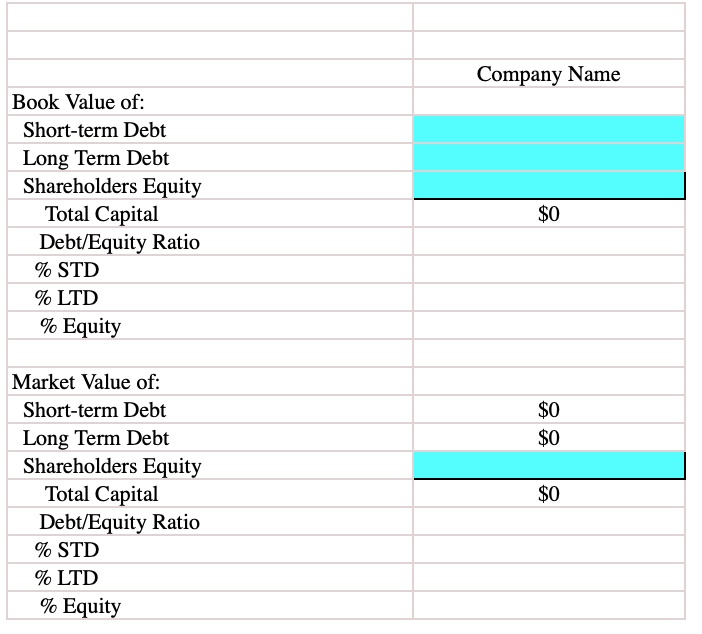

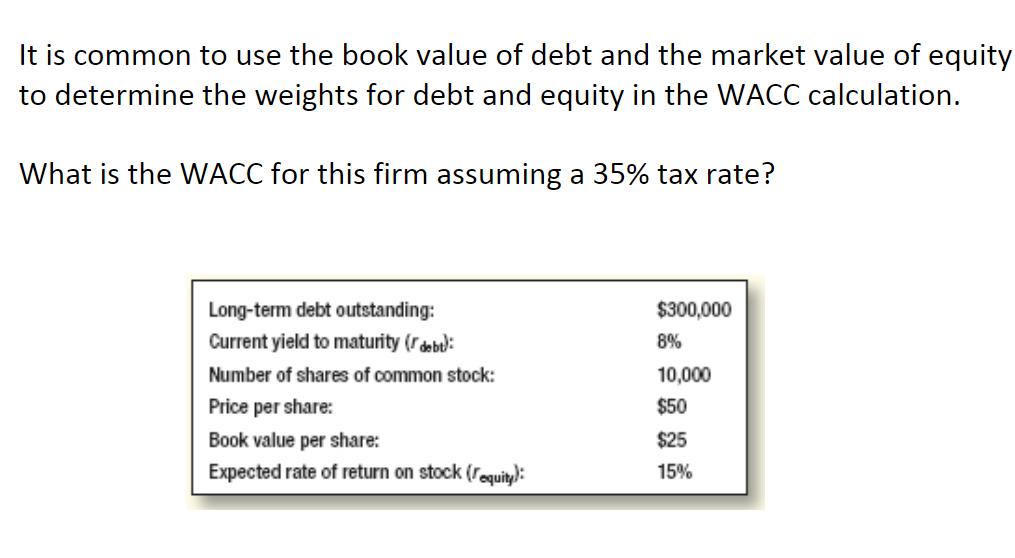

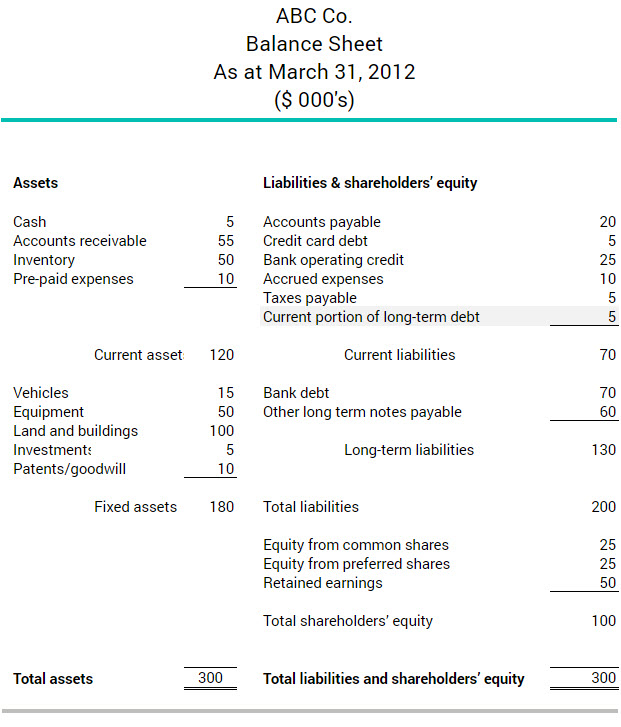

SOLVED: Capital structure is the mix of debt and equity used to finance a firm's assets. Information on a firm's financial statements, but the value of the debt and the value of

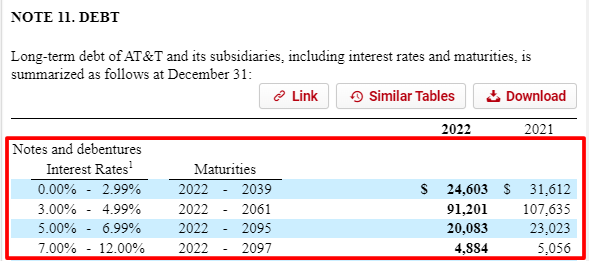

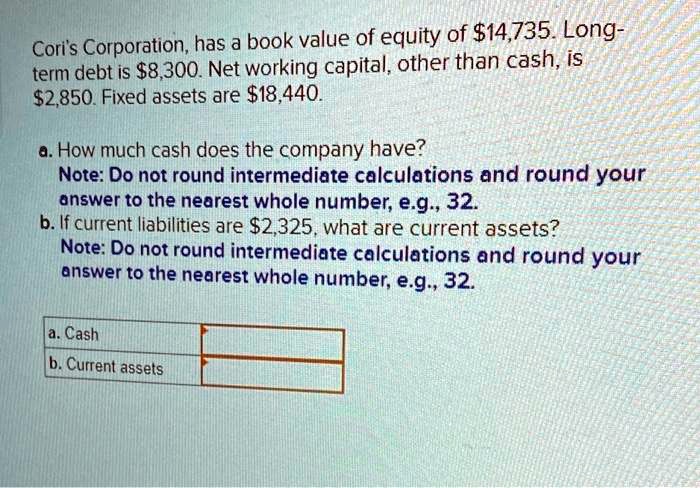

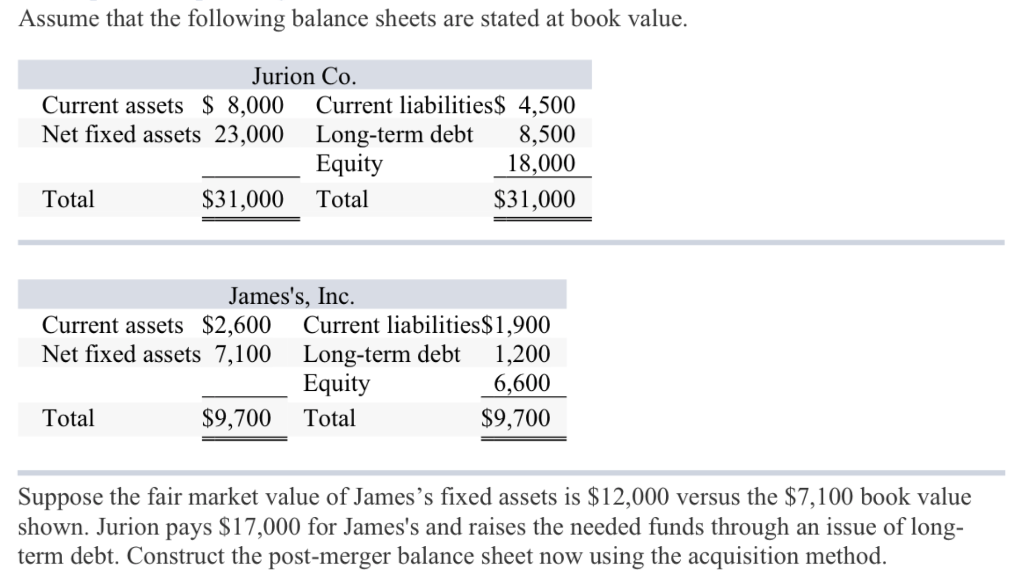

Solved! Market Value Capital Structure Suppose the Schoof Company has this book value balance sheet: $20,000,000 $10,000,000 30,000,000 1,000,000 39,000,000 $100,000,000 Current assets $30,000,000 Current liabilities Notes payable Long-term debt

Thomas R. Ittelson Quote: “Book Value Book value represents the value at which assets are carried on the “books” of the company. The book value of ...”

:max_bytes(150000):strip_icc()/price-to-book-ratio-bf64b6abed4d4d2292f3ab58bd55ed36.png)